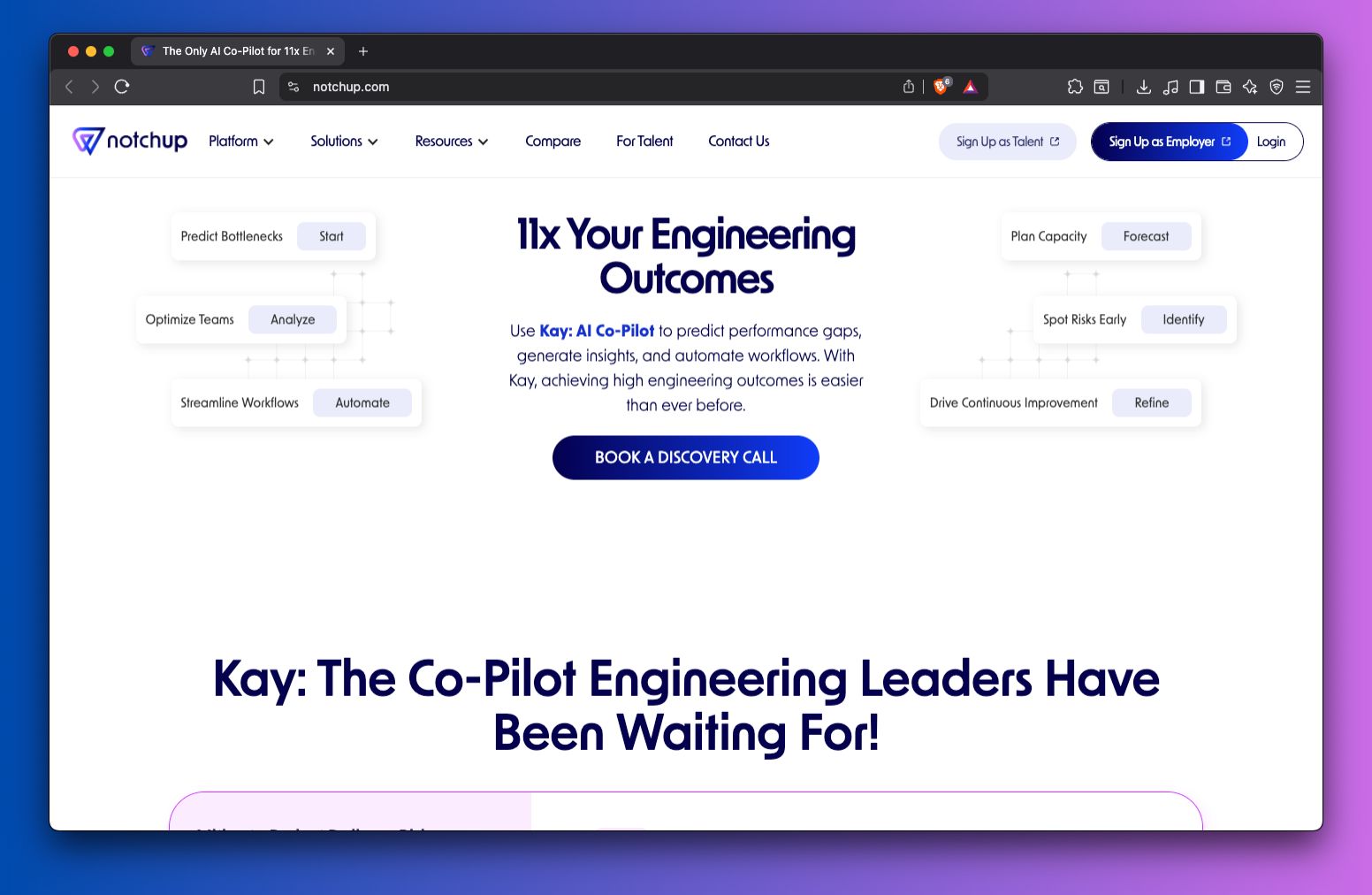

Notchup: Engineering Management Co-Pilot

Founder and CEO: Maulik Sailor

Location: San Francisco/London

Stage: Seed

Website: Notchup.com

Social: LinkedIn

💥 The Big Idea

Engineering leaders are drowning in noise from too many tools, fragmented data, and constant fire drills. Notchup is an AI co-pilot for engineering management. It connects delivery, people, and productivity data so CTOs and VPs of Engineering can run their org like a system instead of a collection of ad hoc rituals.

🧠 How It Works

Notchup plugs into tools like Jira, GitHub, and HR systems and turns those signals into a unified view of the team’s skills, productivity, and output. The platform flags capacity gaps, predicts bottlenecks, and highlights attrition and burnout risk before it hits the roadmap.

🔥 Why We Like It

Most tools give engineering leaders more dashboards. Notchup gives them leverage. It connects the dots between people, process, and product so you can ship faster without sacrificing team health. Miss fewer deadlines, reduce context switching, lower attrition, and achieve more predictable delivery.

Bright. Glossy. Zero-gravity indie dance. The soundtrack for founders riding a surprise win, refreshing dashboards like it’s a slot machine, and celebrating with whatever champagne was already in the fridge. Upbeat and built for momentum.

Never Pitch a VC Without Defining Your Exit Strategy

Ron Wiener, is the chief mechanic at Venture Mechanics, an incubator in the Greater Seattle area, where I am also a mentor.

A tech startup OG (He even did a stint at Eagle Computer), I had him write up some fundraising advice, since I know this is top of mind for many founders.

Investors Want to Know How They (Might) Get Their Money Back

Just as any good novel has a complete narrative arc, the story of your startup needs to include that ever-important endpoint—when investors learn about how they’re going to get their money back, and what kind of premium they can expect for the risk they’ll be taking.

But let’s be honest: for a lot of founders, talking about your exit plan feels like talking about prenups on a first date. But if you sidestep the exit conversation while pitching your beloved startup to investors, you’re setting yourself up for a lot more pain down the line.

This tendency to leave out the exit strategy from a pitch deck has been made worse by certain popular, high-churn accelerator programs (who shall remain nameless) that have literally been preaching to founders that they shouldn’t spend a minute on exit strategy. This is the most wrongheaded advice I can ever imagine being given to a founder.

Before You Pitch, Get Real About Your Market’s M&A Scene

Before your first pitch deck hits a VC’s inbox, you've got homework. Pull up Crunchbase, CB Insights, Pitchbook, plus your favorite AI research tools, and start mapping out the chessboard:

Who’s buying up companies in your sector? Track their deal cadence, deal sizes, and rationale. This is wild west stuff in some verticals—one year, buyers are gobbling up folks left and right; the next, they might be on a diet.

What holes are they trying to plug? Figure out how your company can be that jewel that is missing from potential acquirers' crown, and why they’d enter a heated bidding event to buy you before someone else does.

Kick some tires with partnerships and pilot programs. Many happy corporate marriages start with a handshake and a test run.

Treat this exercise just as you would any market due diligence, not something you’ll “figure out later.” You want to pitch to investors that acquiring you someday is not a far-fetched hope, but somewhere between “likely” and “inevitable.”

Size Matters (But So Does the Story)

The cold truth: most acquirers don’t even look your way until you clear a certain size—usually past $1M–$1.5M in annual revenue for SaaS, or an equivalent growth rate if you’re playing in another arena. Got $5M+ in ARR and that hockey stick graph? Now you’re really in the conversation for $20M–$100M exits. For hardware companies, ARRs typically need to be 2-3x bigger than for SaaS.

But size alone won’t save you. What tech giants crave is strategic value. Maybe you have the user base, the tech, or the talent that fits a buyer’s jigsaw puzzle perfectly. Hot sectors with hype and “buzz” can break all the rules—but don’t count on being a unicorn in a field of horses.

What’s a Startup Worth, Anyway?

Forget what you heard at your cousin’s barbecue. Acquisitions are usually based on 3–5x annual recurring revenue for sane deals. Strategic buyers with champagne dreams may pay more in a bidding war, but unless you’re holding the only life raft in a sea of sharks, anchor your expectations.

Look at:

Revenue multiples in public comparables and recent deals. Their stock is their currency for making acquisitions, so the multiple they’ll pay for you will likely be in the same range as their own.

How “painful” or expensive it would be for a buyer to build your solution themselves.

The “strategic premium” they might pay if you fit their needs today instead of two years from now.

Run Your Business Like You Could Sell It Tomorrow

All this assumes you’re a value builder, not a romantic that plans to “never sell.” Don’t kid yourself, investors don’t like living in a house with no doors. Always signal that you, your co-founders, and your key stakeholders will remain vigilant for potential advantageous exit opportunities at any time.

The best companies I’ve seen run tight ships, know their financials cold, and always have a list of likely buyers taped behind the monitor. Keep your data room tidy, your cap table clean, and your ears open for changing tides in the market.

It’s also a good idea to get to know the best M&A advisors in your geographic region and industry sector, and keep them on speed dial; so when that first call does come in, you can move rapidly into action to draw a heated bidding event and maximize that exit value.

A Note About Financial Exits Versus Strategic Exits

In the world of venture-scale startups, most investors are looking to make their high ROI targets by virtue of strategic exits. Meaning, they’re making money off the stock price pop, not from the free cash flows of the underlying business. The latter type of company that is able to generate high cash flows is going to be able to pursue an alternative financial exit strategy, as well, such as selling to a private equity firm.

Thanks to the burgeoning use of AI to growthhack everything from code development to highly-optimized digital marketing campaigns, we’re seeing a rising trend in founders avoiding priced rounds with institutional VCs altogether, and just building a sustainably profitable business. (This is one reason we developed the Venture Mechanics SAFE Note structure to protect early pre-priced round investors.)

Final Word

Getting your exit ducks in a row before you pitch investors isn’t being idealistic. It’s being professional. It tells investors—and yourself—that you’re playing the long game, that you understand the rules of the road.

On The Gregory and Paul Show, we break down the latest in startups, SaaS, AI, and whatever the internet is debating this week.

🎙️ Episode 025 – How DocuSign Was Really Built, with Court Lorenzini

This episode goes deep into the origin story of DocuSign, how court cases and real estate distribution unlocked product market fit, why founders must be adaptable, the flaw in most hiring frameworks, and where AI cycles are headed.

NEW From Zero to 1M in ARR - How to Market Your Startup: Slides from the most popular talk at Seattle Tech Week. →

100 Reasons Customers Say “No” (And How to Make Them Say “Yes”): A Comprehensive Google Sheet breaks down 100 fixes. →

30-Day SaaS Growth Plan Template: Designed for technical founders who’d rather be building. →

How to get your first 1,000 followers on 𝕏: Building a large following on 𝕏 in 2025 is still possible. →

VC Pitch Deck Templates for Founders: Based on the legendary Sequoia deck, built for real fundraising. →

I'm a former creative director, 3x head of marketing, and founder of Vibe Your SaaS. After 20 years in Silicon Valley, devising new ways to get people to click on things, I now help early-stage B2B SaaS companies scale their businesses through strategic sales and marketing consulting.

Some VYS clients have grown 3x, 5x, 8x, and even 24x while working with me. No, really, one VYS customer grew revenue by an incredible 24x.

Have questions? Want to learn more about working together? Reply to this email. I write everyone back, it’s true. Ask around.

If you think this newsletter is rad (of course you do), help other cool people discover it.

This is your personal referral link: {{ rp_refer_url }}

Share it in your newsletter, blog, emails, wherever, to refer others and get credit towards unlocking cool stuff like this sweet, sweet VYS Guide to Founder-Led Sales, and if you refer 3 people, you can get access to the VYS Slack.

1 referral for this free guide

3 referrals for VYS Slack Connect Access

{{rp_personalized_text}}