It’s 2026, and VYS//IRL is back and better than ever!

For Q1 of 2026, we have secured the AWS Builder Loft in SF for our event on Wednesday, March 11, 2026, for another VC/Founder Mixer. If you’re a founder or investor, apply here to attend.

I still have a few sponsorship opportunities. Reply to this email if interested.

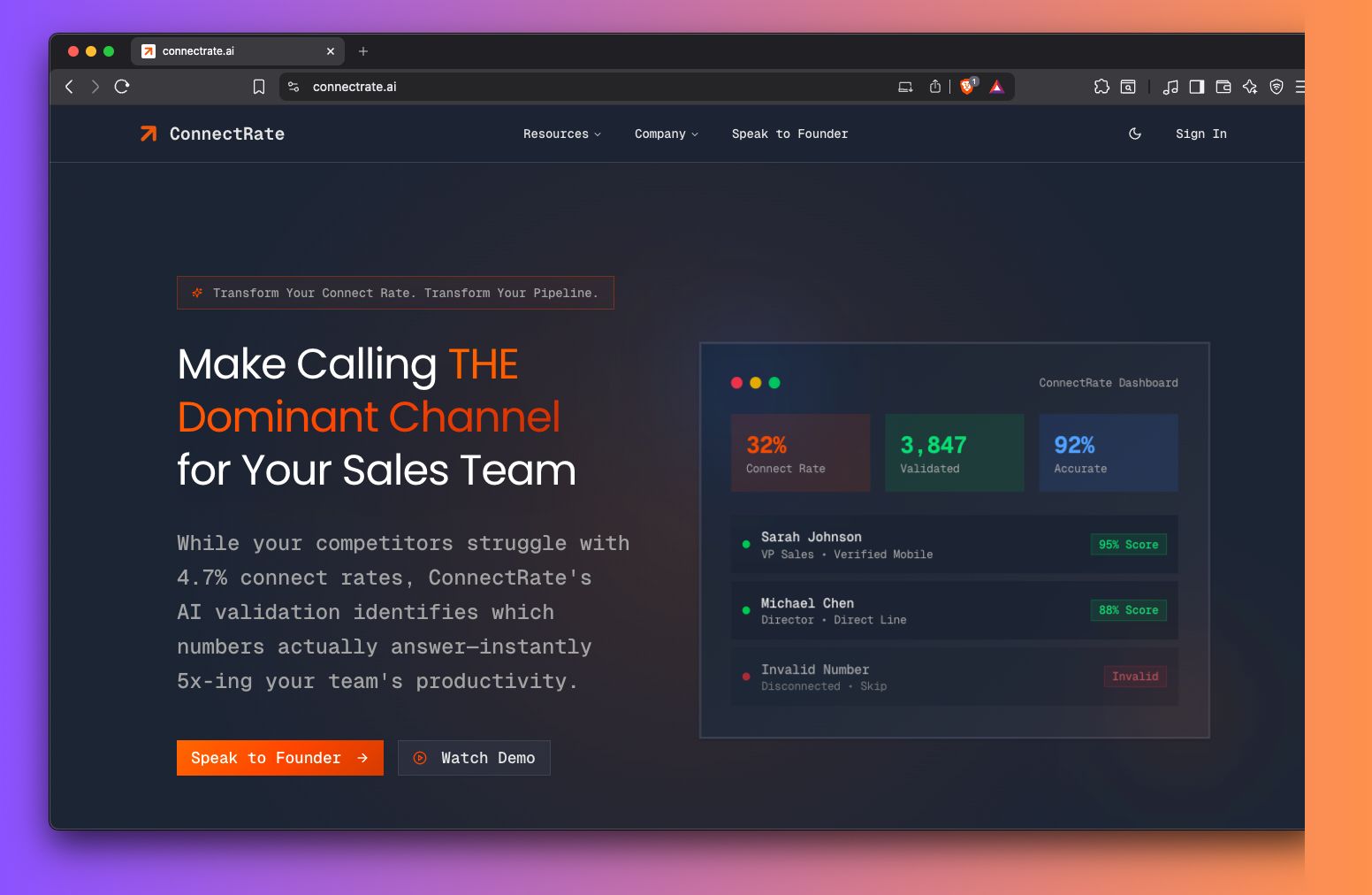

ConnectRate: AI Validation for Phone Numbers

Founder and CEO: Drew Kluender

Location: Cincinnati

Stage: Bootstrapped

Website: Connectrate.ai

Social: LinkedIn

💥 The Big Idea:

Most outbound teams keep buying “more volume” when the real problem is simpler. They are dialing bad numbers. ConnectRate is built to validate numbers before reps waste cycles on voicemails, disconnects, and dead data.

🧠 How It Works

ConnectRate runs a multi-layer phone validation process that checks whether a number is valid, active, and correctly routed, using live carrier-level verification. You filter and validate, and you get a list with a much higher chance of being picked up.

🔥 Why We Like It

This is a rare tool that attacks the constraint, not the symptoms. Dialers, talk tracks, and copy are irrelevant if 95 percent of your calls never connect. ConnectRate’s thesis is to fix data quality first, then let skill and persistence do the rest.

This modern acid house playlist is not nostalgia cosplay. It is the sound of the 303 stripped of irony and put back to work. It is club music for people who stay until the lights come on in a Brooklyn bar, not for people chasing the chorus.

2026 Startup Fundraising Outlook

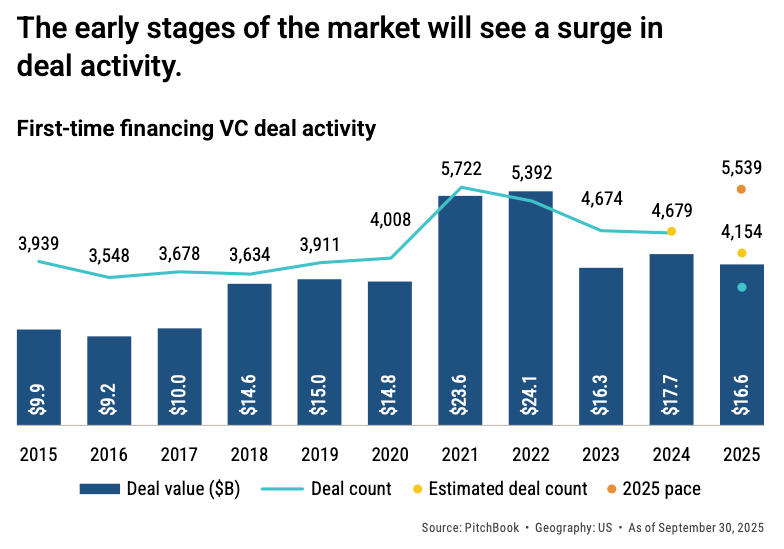

I asked Arjun Dev Arora, the resident VYS fundraising expert, to write this because I kept hearing the same question from founders. Is it even possible to raise right now? Sure, PitchBook's research indicates yes, but only in specific ways.

Arjun’s notes below connect the data to what founders are experiencing in real fundraising conversations.

If you're interested in more of Arjun’s thoughts on the fundraising outlook for founders in 2026, watch this recent episode of Gregory and Paul, which we recorded with him.

I read Pichbook’s 2026 US Venture Capital Outlook, and then I sanity checked it the only way that matters. I ask founders, partners, and the people actually trying to get rounds done right now what they think.

Here is the vibe. Yes, the headlines are still gloomy. Liquidity is the problem. LPs are still waiting to get paid. Fundraising is still slow. But on the ground, the early stage is moving again. It’s not loud. Not flashy, and not easy.

Which means it is nothing like 2021. It’s more like, if you are building something real and moving fast, you can get a check.

Here are my notes on what fundraising will look like in 2026.

1. The seed market is alive again, it is just quieter

PitchBook expects a surge in early-stage deal activity. First-time financings through Q3 of 2025 were only about 200 deals behind 2021. On the street, that matches what I see. More first meetings. More real partner attention. More deals are getting done, even if nobody is bragging about it.

2. Fundraising is weak, but early checks are still clearing

Venture funds raised about $45B through Q3 2025, the lowest since 2017. Yet, early-stage deal count has increased quarter over quarter. For founders, this means investors are rationing attention, but seed and Series A are still where many firms want to place new bets.

3. Dry powder is coming off lockdown

After 2022, many investors slowed deployment until their portfolios stopped getting marked down. The good news is that down and flat rounds peaked several quarters ago, and late-stage activity has picked up. When portfolios stop getting marked down, more investors start writing new checks.

4. AI is the fastest path to a first check right now

It’s no surprise that AI captured about 65% of US VC deal value through Q3 2025. Mega rounds skew it, but the signal is real. Founders with a credible AI wedge are getting pulled forward in the process.

5. AI rounds are happening earlier and faster

37.1% of non-life sciences first financings in 2025 were AI companies. AI startups are younger at first financing, and the median time between rounds is shorter and still falling. The founder's implication is simple. Speed is now a fundraising advantage, not just an execution advantage.

6. The big funds are now seed funds, whether they admit it or not

Large multi-stage firms are increasingly leading seed and Series A rounds. They are showing up earlier because that is where ownership is created and where AI upside is highest. For founders, this means many seed rounds now look and feel like mini Series As.

7. Seed rounds are bigger, but they cost founders more

Seed rounds are larger than they used to be, but that does not mean they are cheaper. Founders often give up more of the company earlier than they realize, especially if the round size creeps up or the valuation does not fully offset it.

8. In 2026, aim for one killer lead investor

If a respected multi-stage firm leads, the round usually moves faster because the signal is strong and the lead can fill gaps if the process gets choppy. It also helps later because the same firm can participate again if things are going well.

9. Startup fundraising is consolidating

Never mind that the All-In Summit might be relocating, PitchBook notes that early-stage startup activity is concentrating back in the Bay Area and New York. You can build anywhere, but capital still clusters. If a founder is outside NYC or the SF Bay Area, the traction has to speak loudly.

10. 2026 will reward builders, not storytellers

PitchBook expects 2026 fundraising to rebound as liquidity improves, with a rough estimate of $100B to $130B raised if momentum continues. We’re not going back to what felt like a never-ending rave in 2021. 2026 will be a market that rewards execution and punishes wishful thinking.

🎙️ 029 The Gregory and Paul Show - a16z 15B fund, AI reality checks, and why Bowie was right

A running joke about YouTube comments turns into a sharp conversation on A16Z’s sovereign wealth scale, why big companies are now measuring AI usage like a KPI, how open source gets kneecapped when devs stop visiting docs, and why David Bowie’s 1999 internet take still explains the entire modern content economy. The episode closes with a bigger claim. AI is real. The way people are trying to use it is mostly boring. The real shift is still ahead.

I'm a former creative director, 3x head of marketing, and founder of Vibe Your SaaS. After 20 years in Silicon Valley, devising new ways to get people to click on things, I now help early-stage B2B SaaS companies scale their businesses through strategic sales and marketing consulting.

Have questions? Want to learn more about working together? Reply to this email. I write everyone back, it’s true. Ask around.

If you think this newsletter is rad (of course you do), help other cool people discover it.

This is your personal referral link: {{ rp_refer_url }}

Share it in your newsletter, blog, emails, wherever, to refer others and get credit towards unlocking cool stuff like this sweet, sweet VYS Guide to Founder-Led Sales, and if you refer 3 people, you can get access to the VYS Slack.

1 referral for this free guide

3 referrals for VYS Slack Connect Access

{{rp_personalized_text}}